Covered Call example:

Covered calls are a great way for investors to earn some money from stocks that they intend to hold for a long time. Let us understand the benefits and risks using a covered call example.

Read about the concept of covered calls Click here

One of the main problems in investor portfolio’s is getting married to a stock. Covered call removes this problem by setting a sell price for every month.

For an explanation of the concept of covered calls read how to earn rent from stocks.

Let us look at a covered call example:

Reliance covered call

On date: 13-07-2020

-

Buy the shares.

The most important part of a covered call is having the underlying i.e. the shares on which we will sell(also called writing) a Call.

Purchase Price: Rs. 1938 per share

Quantity: 1 lot which is 505 shares of reliance.

(why we need to buy 505 shares or 1 lot? Read our concept explanation)

-

Decide on a strike price.

We need to decide a price at which we will are ok to sell our shares of reliance.

Let us assume in 1 month if the share price rises 5% we are happy and willing to sell our shares. The share price with a 5% increase in price.

1938 + 5% of 1938 = 1938 x (1+5/100) = 1938 x 1.05 = 2034

We have our minimum Strike Price.

Strike Price is the case of a covered call is the price above which we are willing to sell our shares.

-

Find the option chain and check the premium we can take for promising to sell our shares if price is above our strike at the end of the month.

-

Google: option chain share name.

For us this is: Reliance. We google: option chain reliance.

-

Click the first link. Not the sponsored results.

-

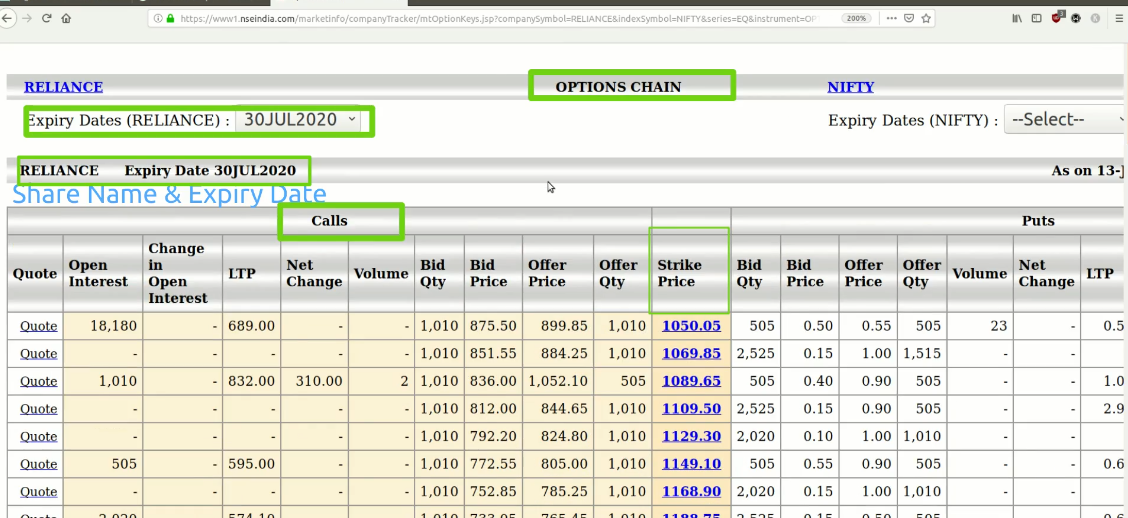

You will reach the NSE website showing the option chain for reliance.See picture below.

-

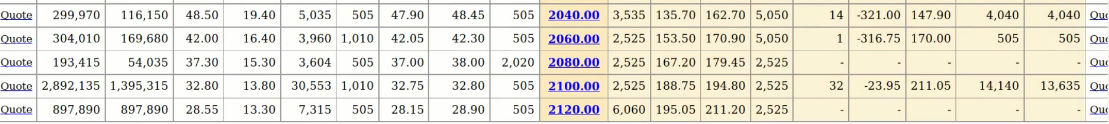

In the center there is a column called Strike Price(highlighted above). Find a strike price equal to or higher than our minimum strike price(2034) from our Step 2. In the picture belowthis is: 2040. Our Strike Price: 2040

-

Under the calls section(left of the strike price) there will be a “Bid” and “Ask”.

-

The Bid in the row of strike selected is the Premium per share that we can get if we write the call(sell the call).

-

From the picture we see the bid price for strike price 2040 is: 47.90 per share.

-

-

Place the order.

-

Call your broker and tell them to sell a Call on Reliance, Strike price 2040, price: 47.9.

-

Make sure you ask them to repeat the order back to you.

-

I would advise against placing the order by yourself if you are new to options trading.

-

Sit back and wait till the last thursday of the month. You have just made:

47.9 x 505 = 24,189.5 Rs.

Let us go deeper into our possible profits and loss:

Calculate our possible profit:

If at the expiry(last thursday of the month) price of Reliance is 2100:

Amount we invested to buy reliance shares:

Purchase Price x Quantity = 1938 x 505 = 978,690

We can pledge these shares to get margin for writing/selling the call.

(Your broker will charge an interest, please check.)

Profit in covered call when price of shares is above our Strike Price on expiry:

Profit from Relaince Shares + Profit/Loss from Selling Call + Premium from selling call

= (Sale Price – Purchase price) x Quantity + (Strike Price of Call – Current Market Price) x Quantity + Premium x Quantity

= (2100 – 1938) x 505 + (2040 – 2100) x 505 + 47.9 x 505

= 162 x 505 + (-60) x 505 + 24,189.5

= 81,810 – 30,300 + 24,189.5

Maximum Profit = +75,699.5

Our return percentage = 75,699.5/9,78,690 = 0.07734 x 100 = 7.73 percent in 30 days or less.

The maximum profit in a covered call strategy is the strike price minus purchase price of shares plus premium that we collected multiplied by the quantity.

If price goes is below the purchase price of shares, let us assume 1,850:

Unrealised Profit/Loss = (Current Market Price – Purchase Price) x Quantity

= (1,850 – 1,938) x 505

= -44,440

Realized Profit

= Premium from Selling Call x quantity

= 47.9 x 505

= +24,189.5

If price stays the same: 1938 at expiry (pre-set date at which our call expires, last thursday of the month):

Unrealised Profit/Loss

= (Current Market Price – Purchase Price) x Quantity

= (1,938 – 1,938) x 505

= 0

Realized Profit

= Premium from Selling Call x quantity

= 47.9 x 505

= +24,189.5

Benefits:

-

Better than holding shares without earning anything from them.

-

If the price stays the same for a few months we keep making 1-2% every month.

-

Although our profit is capped, we get to sell our shares at a profit and look for other opportunities.

-

Helps avoid unrealized profit trap.

Risks:

-

The share price drops 20-30%

If the share price drops to a level where the minimum strike price where we want to sell does not have any buyer we are stuck holding the shares. This strategy should be used with shares that you want to hold even if price drops.

-

Profits are capped.

Since we have set a price at which we are willing to sell our shares(Strike Price) we miss out on some opportunities where the price may rise above our strike price. In the long run if you do this enough number of times, the profits will outweigh those returns.

When, why and should you use Covered Calls: Click Here

Get insurance for your stocks, understand the concept: Click Here

See our options guides. Click here

All information here is for educational/research purposes only, we do not recommend trading.