Put option explained like a house.

Insurance for stocks seems like a far fetched idea to new investors. This is because the explanationof the concept of insurance for stocks becomes full of jargon.

What does insurance for stocks mean?

If price of your stock goes below an insured price the insurance company will pay you the difference between insured priced and current price.

You have to pay a premium periodically to get the insurance.

This type of insurance in technical terms is called a put option.

Why insure your stocks?

We insure things to preserve value and protect ourselves from accidents and theft, items that we insure:

- House/Property

- Car(s)

- Phones

- Computer

- Life

- Other high priced items

All of the items have somethings in common:

- High value

- Possible accident potential

- Our inability to fix on our own

- Value store for uncertain times

We can rewrite the list above in a single line as:

High priced items which might lose value due to reasons we cannot predict.

The list does not include one of our second/third largest high price items i.e. Investments in shares. Then we must find a way to insure our stocks.

How to insure your stocks?

We see the problem, now we need to find a solution.

In stocks, insurance is called a PUT option. But not all stocks can get insurance.

This is an interesting proposition should you have stocks in your portfolio that no one is willing to insure?

I would want to keep a very small percentage think 1-2% of the portfolio in stocks which can’t be insured.

Before we invest a big chunk of our money into a stock we should look whether we can get insurance on it.

How to check whether we can get insurance:

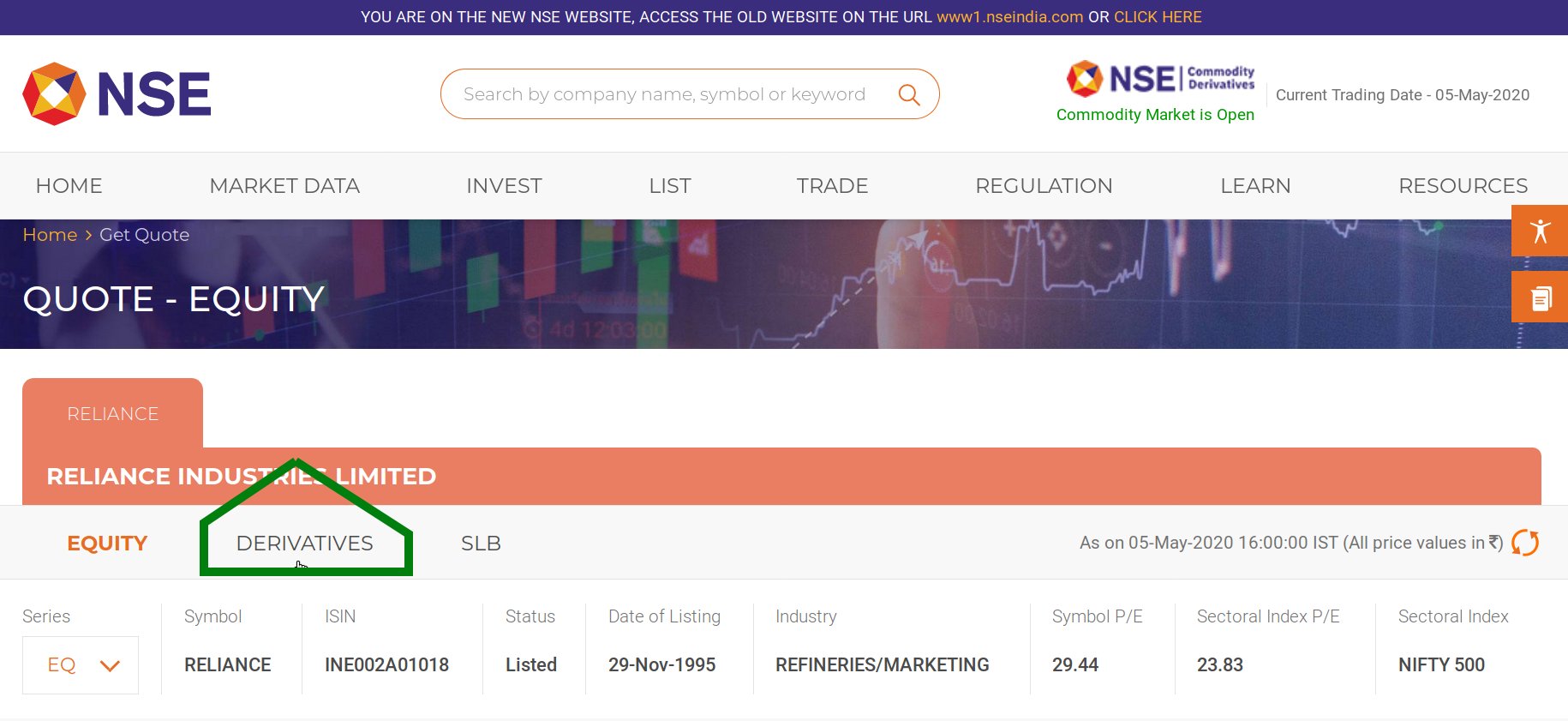

- Go to www.nseindia.com

- In the search box type the name of the share, select the share from the dropdown.

-

See if the following marked in green is showing, click it and we see the option chain.

If the option chain is present we can go ahead and decide to buy the stock.

Note: Insurance is available on a lot of shares, think of this as house insurance is available but a single room in a house can’t be insured. What is a lot of shares? Click here for explanation

A lot can also be understood as the minimum number of shares that you can get insured. For example: You can’t get insurance on 1 seat in a car, you have to get insurance on the car.

We have now bought a lot worth of shares. Let us assume the lot is 200 shares.

Our aim is to make sure the value of the stock doesn’t go down too much let us say we are OK with a 20% loss in share value and the current share price is: 100.

If the stock goes down to 80 we are fine but we want to protect ourselves from any further loss. We ask the insurance company to insure the value at 80 i.e. if price goes to 60 we want the insurance company to pay us 20.

Here the insurance product is the derivative called PUT option.

We want to buy insurance so we will have to pay a premium and the policy has to be renewed at a certain date.

The premium let us assume is 1%, i.e. 200 amount for insurance of our 200 shares. The renewal date is called: Expiry Date

We pay the insurance company: 200 as premium to protect our share value.

Lets take a look at what can happen over a few months:

| Stock Price: (month opening) |

Insured Value | Premium Paid | Closing Stock Price | Profit/Loss | |

|---|---|---|---|---|---|

| 100 | 16000 | 200 | 90 | -200 | |

| Price of stock at the beginning of the month | Price x Quantity x 80/100 = 16000

80% of stock value is insured. |

1% is the insurance premium.

Price x Quantity x 1/100 = 200 |

Stock price at end of the month. | The insurance premium is kept by the insurance company. It will be considered a loss. | |

| Stock Price: (month opening) |

Insured Value | Premium Paid | Closing Stock Price | Profit/Loss | |

|---|---|---|---|---|---|

| 90 | 16000 | 300 | 85 | -300 | |

| Price of stock at the beginning of the month | Purchase Price x Quantity x 80/100 = 16000

80% of stock value is insured. |

1.5% is the insurance premium.

Purchase Price x Quantity x 1.5/100 = 300 |

Stock price at end of the month. | The insurance premium is kept by the insurance company. It will be considered a loss. | |

| Stock Price: (month opening) |

Insured Value | Premium Paid | Closing Stock Price | Profit/Loss | |

|---|---|---|---|---|---|

| 85 | 16000 | 400 | 65 | +3000 – 400 = +2600 | |

| Price of stock at the beginning of the month | Purchase Price x Quantity x 80/100 = 16000

80% of stock value is insured. |

2% is the insurance premium.

Purchase Price x Quantity x 2/100 = 200 |

Stock price at end of the month. | Our stock value is below our Insured value(16000), insurance company pays us:

Insured Value – Current Value = +3000 and keeps the insurance premium of 400 |

|

| Stock Price: (month opening) |

Insured Value | Premium Paid | Closing Stock Price | Profit/Loss | |

|---|---|---|---|---|---|

| 85 | 16000 | 400 | 110 | -400 | |

| Price of stock at the beginning of the month | Purchase Price x Quantity x 80/100 = 16000

80% of stock value is insured. |

2% is the insurance premium.

Purchase Price x Quantity x 2/100 = 200 |

Stock price at end of the month. | The insurance premium is kept by the insurance company. It will be considered a loss. | |

| Stock Price: (month opening) |

Insured Value | Premium Paid | Closing Stock Price | Profit/Loss | |

|---|---|---|---|---|---|

| 85 | 16000 | 400 | 130 | +5600 | |

| Price of stock at the beginning of the month | Purchase Price x Quantity x 80/100 = 16000

80% of stock value is insured. |

2% is the insurance premium.

Purchase Price x Quantity x 2/100 = 200 |

Stock price at end of the month. |

We sell the stock for 130, our profit is: (Sale Price – Purchase Price) x Quantity = (130 – 100) x 200 = +6000 The insurance premium is kept by the insurance company. It will be considered a loss. Out Total PL = +6000 – 400 |

|

As you can see, more often than not getting insurance for your stocks is prudent. If the share price increases then the insurance premiums paid are usually covered by the profit, otherwise our value is insured to a certain extent.

Earn Rent from your stocks: Click here to learn What are futures and options: Click here to learn We hope put option have been properly explained.

All information here is for educational/research purposes only, we do not recommend trading.